On 10 April 1806, the United States Congress enacted 101 Articles of War, which were not significantly revised until over a century later. Įffective upon its ratification in 1788, Article I, Section 8 of the United States Constitution provided that Congress has the power to regulate the land and naval forces. On June 30, 1775, the Second Continental Congress established 69 Articles of War to govern the conduct of the Continental Army. If you have any questions regarding this determination, you may contact ***** in the Office of Tax Policy, Appeals and Rulings, at *****.Further information: Articles for the Government of the United States Navy In order to do so, the Taxpayer must show by clear preponderance of evidence that the property is assessed at more than fair market value. In the matter of property valuation, the burden of proof lies with the Taxpayer to rebut the presumption of correctness. The valuation method employed by the City in this case is consistent with the statutory requirements.

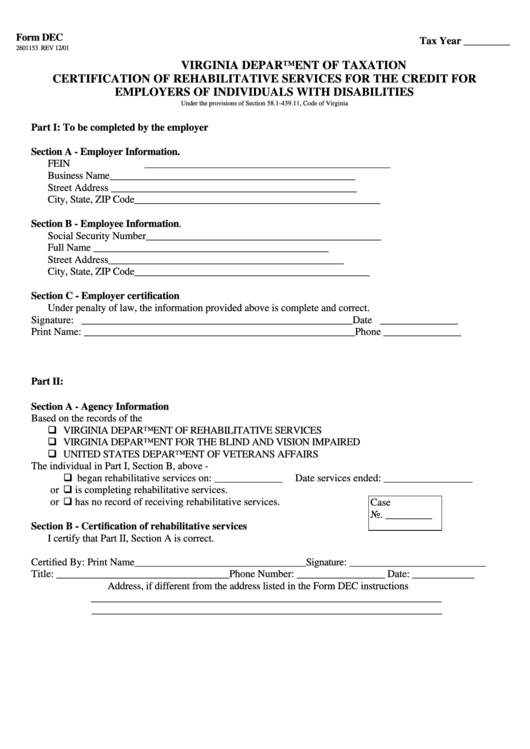

CODE OF VA 58.1 SECTION CODE

Under Virginia Code § 58.1-3503 A 18, the BTPP sold to the Taxpayer is to be valued by using a percentage or percentages of original cost in order to determine FMV. Although the General Assembly has provided no definition for the term “original cost,” it has consistently been interpreted to mean the cost paid by the original purchaser from a manufacturer or dealer and not the cost paid by subsequent purchasers.

Virginia Code § 58.1-3503 A 18 specifies that for most items of tangible personal property that is used in a trade or business, FMV is to be ascertained either by a percentage or percentages of original cost. If the valuation methodology employed by a locality results in an assessment well above fair market value, the locality may use another methodology prescribed in Virginia Code § 58.1-3507 B. Virginia Code § 58.1-3103 specifically charges local commissioners with the responsibility of assessing property at fair market value.įair market value is generally defined as the price a property will bring when offered by one who desires, but is under no obligation, to sell it, and the buyer has no immediate necessity to purchase it. Article X, §§ 1 and 2 of the Constitution of Virginia provide that all property, unless specifically exempted within the provisions of the Constitution, shall be taxed at a uniform rate among classes, and that “all assessments of real estate and tangible personal property shall be at their fair market value to be ascertained as prescribed by general law.” This provision of the Constitution contains the presumption that the General Assembly’s prescribed valuation method will both standardize valuation practices across all the local governments in the Commonwealth and result in something approximating FMV. seq., is reserved for local taxation by Article X, § 4 of the Constitution of Virginia. The Taxpayer appealed to the Department, contending the City improperly estimated the FMV of the property.Īll tangible personal property, unless declared intangible under the provisions of Virginia Code § 58.1-1100, et. In its final determination, the City concluded that it had properly assessed the BTPP tax based on a percentage of the equipment’s original cost. The Taxpayer appealed to the City, contending that the assessed value did not reflect the true FMV. Under audit, the City determined the FMV by using a percentage of the original cost and issued assessments.

The Taxpayer used the purchase price of the property as the fair market value (FMV) for purposes of computing the BTPP tax due to the City. The Taxpayer acquired items of BTPP when it purchased several franchise restaurant locations in the City.

The Code of Virginia sections and public documents cited are available online at in Laws, Rules, and Decisions section of the Department’s website. The following determination is based on the facts presented to the Department summarized below. On appeal, a BTPP tax assessment is deemed prima facie correct, i.e., the local assessment will stand unless the taxpayer proves that it is incorrect. Virginia Code § 58.1-3983.1 D authorizes the Department to issue determinations on taxpayer appeals of BTPP tax assessments. The BTPP tax is imposed and administered by local officials. You appeal assessments of business tangible personal property (BTPP) tax issued to the Taxpayer by ***** (the “City”) for the 2017, 2018, and 2019 tax years. This final state determination is issued upon the application for correction filed by you on behalf of ***** (the “Taxpayer”) with the Department of Taxation.

0 kommentar(er)

0 kommentar(er)